Student debt is one of the primary economic problems facing Millennials and others who have recently left college. When analyzing this national issue there’s good news and bad new. I’ll give you the good news first.

The good news is that more people graduating from college than ever before. According to the US Census Bureau, a little more than 1/3 of all Americans have earned a bachelor’s degree. That’s over a 5% jump in ten years.

The rates have spiked for good reason. Earning a degree from a four year university has never been more valuable. People with at least a bachelor’s degree earn 98% more an hour than people without one. What’s more, not going to college can cost you as much as $500,000, according to a paper published in Science. Economist David Autor arrived at this number by subtracting the lifetime difference between the earnings of college graduates and everyone else. To put it plainly, the pay gap between those with a diploma and those without has grown into a canyon.

But this surge in education comes at a cost – literally. That brings me to the bad news.

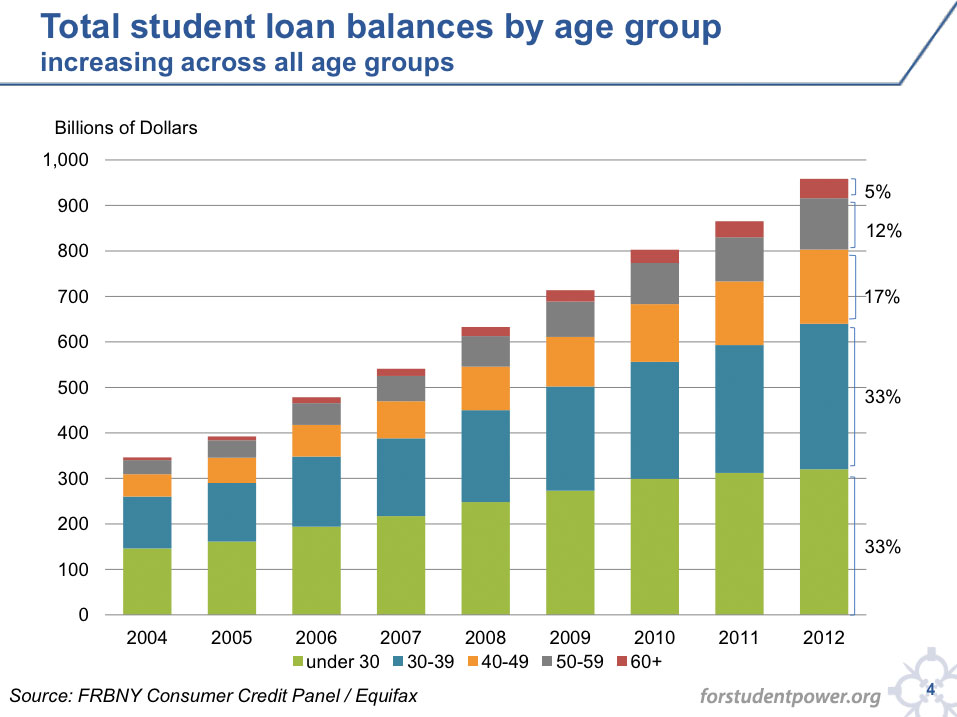

The bad news is that student debt has hit an all-time record in this country. I’m sure you’ve read the headlines and seen the news stories on TV, but I want to make sure you really understand just how grim the situation really is.

Right now over 44 million Americans are bogged down with student debt. If you tally up all the student debt in this country the total bill comes in around $1.45 trillion. That’s bigger than all the combined credit card and auto loan debt in the US. And larger than the rest of the world’s student debt, combined.

What's more, the number of people in debt keeps growing. The Washington Post reports that every year more than 71% of new graduates leave school owing money. That’s more than 7 out of every 10 recent grads that you know.

As student debt skyrockets, it has more than tripled as a share of the total debt owed by US families. According to Bloomberg News, student debt now represents 10.6% of all U.S. household debt. That means for every dollar American families owe, 11 cents of that is from student loans.

The student debt problem doesn’t just impact individuals. It’s so pervasive that it disrupts the entire US economy. The ripple effect influences the housing market and the retail industry, for example.

A consequence of the raising student debt is that homeownership among young Americans is down. According to research by the Federal Reserve Bank of New York, homeownership by young adults is down by as much as 35%. It’s estimated that over 360,000 more young Americans would've bought houses if they weren’t hindered by college loans.

Experts blame student debt for a national drop in retail. During the Great Recession (2008-2012) many customers that normally bought high end products “traded down,” or bought cheaper products at places like Wal-Mart or Target. Usually, the pattern of trading down cycles out after an economic crisis, but following the Great Recession the trend continued. Charlie O’Shea, a retail analyst at Moody’s Corporation, points to student debt as the cause.

O’Shea talks about trading down: “Now that’s usually a temporary phenomenon because recessions don’t last forever. [But] the student loan problem isn’t going away. So you can see permanent trade down. Which … could stay around for a long time.”

If you calculated the combined annual interest of every student loan in the country it would add up to approximately $80 billion, and when you tack on the normal principle payments that number grows to a whopping $160 billion a year. That’s more than Amazon’s annual revenue.

O’Shea observes that, that’s money disappearing from our economy. He says, “$160 billion dollars is meaningful money. Retail sales are 3 1/2 trillion. The math on that is roughly 4% is going out the door to service student loans.”

The truth is that student debt threatens our whole financial system. Consumers don’t spend as much money and the economy doesn’t have the potential to grow as fast as it normally would. Factors like an aging population and low productivity growth play a part in this. But student debt is a component, as well. According to experts two major factors contribute to the surge in debt – raising tuition costs and for-profit colleges.

College tuition costs have skyrocketed over the past decade. Public universities and colleges have historically been a cheaper alternative to expensive, private institutions. But during the Great Recession many states were forced to slash their high education funding.

When budgets are reduced, universities and colleges generally make up the difference by raising tuition costs (along with cutting staff and services). For that reason, public colleges and universities hiked their tuitions to offset budget cutbacks and growing costs. On average tuition at public colleges has increased by 29% since 2008.

It’s been almost ten years since the onset of the recession, and “in almost all states, higher education support remains below what it was in 2008,” according to Center on Budget and Policy Priorities. These tuition jumps have forced students to take out more and more loans.

For-profit colleges aren’t just a slice of the student debt problem – these schools are a disproportionately large segment, according to a report by the Brookings Institution.

These private sector schools include some familiar names -- University of Phoenix, Devry, Full Sail, Argosy, etc. They are operated like businesses, and many of them are traded on the stock exchange.

For-profit colleges generally target older and lower income individuals. They use opportunistic advertising to hook them, promising a new lease on life and a brighter future. At the very least they “guarantee” a college education customized for people who don’t have the money, time, or ability to attend traditional colleges.

Over the years their marketing has proven to be successful. From 2000 and 2011, enrollment at for-profit colleges grew from 3% of total enrollment to 9%.

As attendence exploded so did the debt of cash-strapped students. The amount of debt owed by those at for-profit colleges grew from $39 billion in 2000 to $229 billion in 2014.

To make matters worse, many of these for-profit institutions fail to deliver on the most basic promise of college -- a degree and potential for a better career. According to Slate, the “graduation rate among for-profit colleges is 23%, compared to 59% at public institutions and 66% at private nonprofit schools.” The result is that individuals are in the same place they were before — except they’re a whole lot poorer with loans to repay.

It might take decades to resolve the student debt problem. Some think debt forgiveness is the answer. Others advocate tuition free college to protect future generations. One of the more interesting solutions is student loan repayment assistance from employers. Whatever the resolution it’s import to tackle the problem head-on before the issue spins further out of control.