Auto purchases have exploded. In the past year alone Americans have bought nearly 17.5 million new vehicles. That’s the biggest number since 2000. And it jumped about two-thirds from 2009.

Customers leasing cars is on the raise, too. There are several factors why people are getting vehicles – the growing economy, cheaper gas, and it’s easier than ever to finance automobiles.

Last year the percentage of new cars paid for outright was less than 15%, according to Experian Automotive. Over 50% of used cars sold last year were financed, as well.

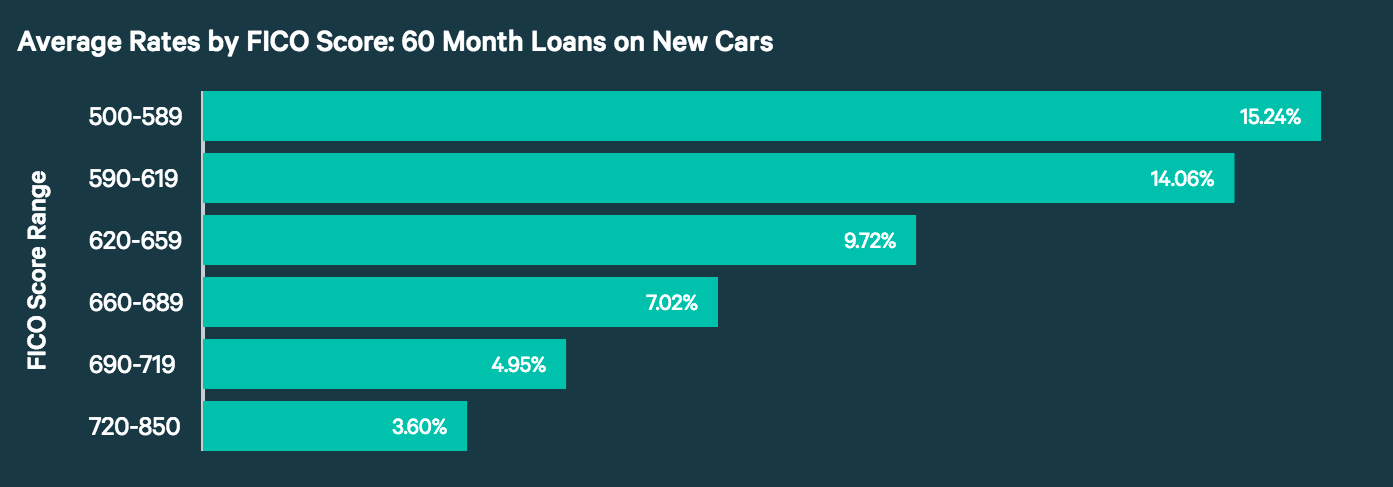

Cars are not cheap, so it’s reasonable that the majority of the cars bought in this country aren’t bought outright. The average new car costs $33,000, and used cars cost $18,000 on average. What’s disconcerting is that a lot of these vehicle purchases are funded by subprime loans.

That’s right, subprime loans – the same type of financing that helped bust the housing bubble and contributed to the Great Recession.

The subprime auto loan boom was born in the aftermath of the 2008 Financial Crisis. At that time the Federal Reserve cut the benchmark interest rates on short-term loans for banks to nearly zero.

Since then defaults on delinquent subprime auto loans spiked at 5%, according to Fitch Ratings. The number of defaults during the Great Recession weren’t even that bad. And that’s worse that the amount of defaults after the dot-com bubble, too.

Although the numbers are bad, many experts don’t think the current auto loan situation will rival the subprime housing crisis. That’s because cars are generally seen as a basic necessity of life for most people. Folks are more likely to make their monthly car payment than almost any other bills. They have jobs and other responsibilities to commute to. And the truth is most public transportation in this country is less than adequate, so most people can’t afford to get their cars repossessed.

What’s more, cars are simple for a financer to take away when a borrower gets behind on payments, according to Barry Ritholtz from Bloomberg View. With homeowners it can take years to seize property. Car owners, however, can get their vehicles confiscated after missing just a couple months. GPS tracking makes it easy for repo drivers to recover cars and most vehicles feature technology that can shut them down remotely.

Although the prevailing theory is that the current subprime auto loan trend won’t lead to a new financial crisis, the rising default numbers are still disturbing, to say the least.

In addition to the defaults, subprime auto and housing loans have something else in common – a history of discrimination. African Americans and Hispanics are more likely to get sold add-on products when buying a vehicle, according to a 2014 report by the Center for Responsible Lending. Reportedly, dealers have been coercing people of color into taking on extra features by telling them they wouldn’t get approved for loans without them.

Also in numerous instances nonwhites paid more for financing than their Caucasian counterparts. Lenders providing the financing establish the loan rate, however, the dealers can then add more interest if they deem it necessary. Many dealers have been exposed for disproportionately adding more interest to the rates of black and brown people.

Recently, the federal government has stepped in. A number of car loan issuers have been slapped with cases, and are settling with the Feds. These suits state that the financing companies should have known what was happening at dealerships, and should have stopped it.

Groups like Toyota Motor Credit are the new Ally Financial. Toyota in particular will have to refund over $20 million to black and Asian consumers who took out loans with them.

As the famous George Santayana quote goes: “"Those who do not learn history are doomed to repeat it." Dealers, financing companies, customers, and financial experts need to heed the lessons of the past subprime home loan crisis. If they don’t will the current subprime auto loan trend contribute to a new recession? Only time will tell.